With equity market valuations at all-time highs and bond yields at historic lows, investors are left with few attractive choices to consider when it comes to allocating capital in their portfolios. The long-term outlook for equity returns from this level is challenging and bond investors face shrinking yields at a time when over $15 trillion of global debt trade with negative yields[1]. What other options do investors have to choose from?

Enter private real estate.

Investors can access private real estate investments in several ways, ranging from buy-and-hold “Core” strategies that seek stable cashflow over a long investment horizon, to “Opportunistic” strategies focused on generating significant capital growth through real estate development or asset repositioning. While private real estate may be an unfamiliar asset class for many individual investors, there are a few key reasons why investors should pay closer attention. Below we’ll take a look at why it might deserve a place in your portfolio.

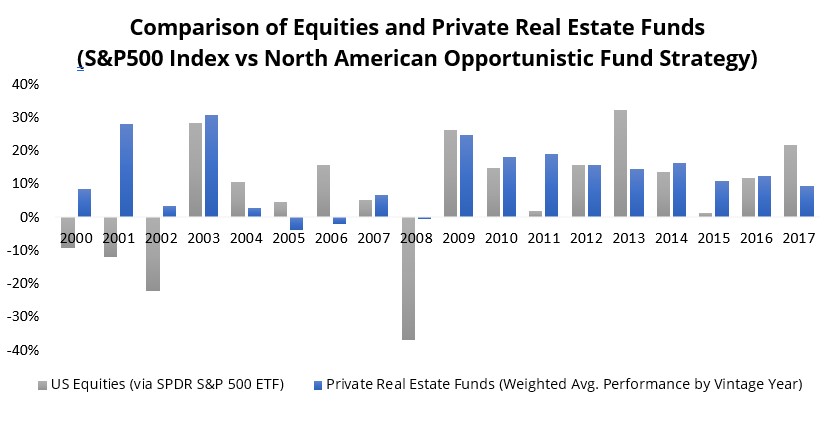

From 2000 to 2017, private real estate funds focused on Opportunistic strategies in North America (i.e. development, asset repositioning, private debt and other special situations) produced an average annual return[2] of 12%, compared to a 6.9% average return that an investor would have realized by investing in the S&P 500 index (via the SPDR S&P 500 Index ETF) over the same time period. Notably, the average opportunistic real estate fund over this time period did not see substantial drawdowns that the S&P500 index suffered from 2000-2002 and in 2008.

The performance of private real estate investments tends to be more closely aligned with the value of the underlying asset and/or the value of the associated cashflow stream. Contrast this to public markets, which can be subject to extreme swings in investor psychology/sentiment, and indiscriminate selling during periods of volatility that can easily cause stock prices to be come detached from their underlying fundamentals and asset values.

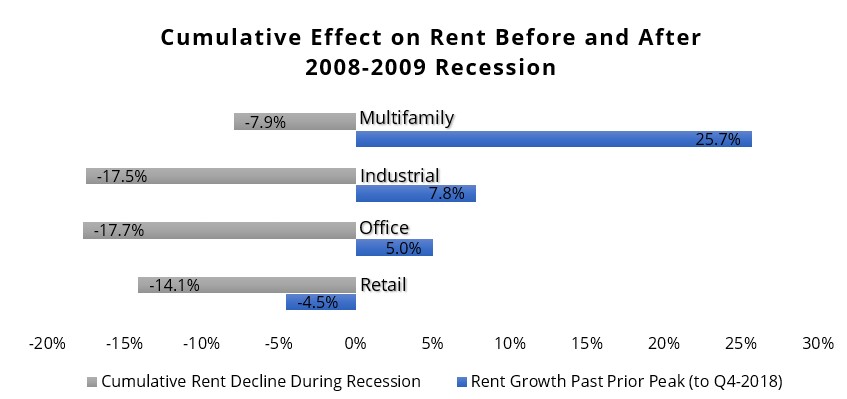

Multifamily apartment assets tend to be among the most recession resilient compared to other commercial real estate types such as industrial, office, or retail. During the 2001 recession, the cumulative rent decline for multifamily assets was 6.7% compared to industrial and office that declined 7.4% and 17.7% respectively. Not only was the total decline the smallest for multifamily, but the post-recession recovery was also the strongest with rents growing an average of 10% before the next downturn, compared to 4.3% for industrial and 5.7% for office buildings. Similar out-performance of multifamily real estate compared to other commercial real estate types during the recent 2008-2009 recession can be seen in the chart below[3].

While the impact of the COVID-19 pandemic is still yet to be fully understood, early indications suggest a similar level of performance with multifamily (and industrial assets) holding up the strongest, while many office and retail assets are suffering notable drops in rent and potentially in their asset value over time. With housing being a fundamental need, multifamily assets are generally more immune to the same disruptive forces that have upended the retail segment over the past decade and may have similar impact on the demand for office space in the coming years, including changes in preferences among tenants, employers and consumers in response to either disruptive technologies or even pandemics such as COVID-19. In addition, tenant risk in multifamily assets is generally lower, with a larger and more diverse tenant base compared to other commercial real estate where a single tenant may occupy a substantial portion of the leasable area. One-year lease terms that are common in multifamily apartments also allow for rents to more closely track inflation, whereas other assets (office, retail, industrial) will have multi-year leases that typically renew every 3-5 years, thus limiting the ability for owners to match rent increases with annual inflation.

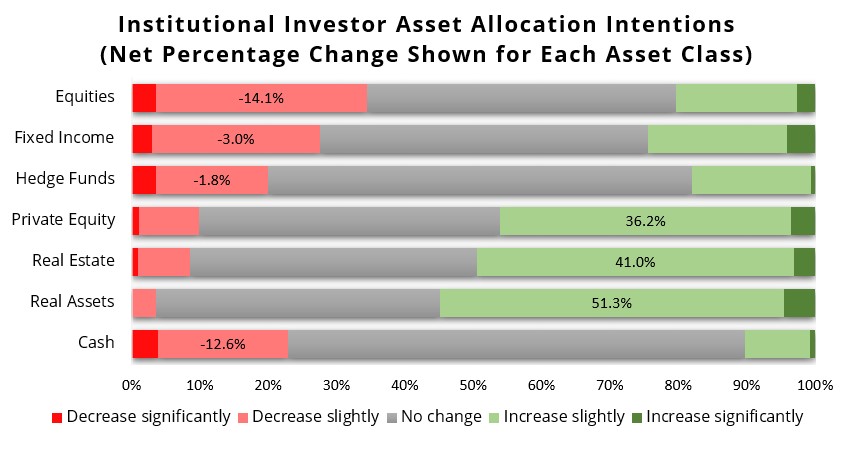

Sophisticated institutional investors such as pension funds, sovereign wealth funds, insurance companies, and endowments typically have diverse portfolios that include not only equities and bonds (fixed income), but also alternative assets such as hedge funds, private equity, real estate, and real assets (infrastructure). Notably, the below survey of global institutional investors from investment manager BlackRock[4] shows a strong preference for rebalancing away from equities and fixed income and towards strategies such as real estate and real assets. The net change (percentage of respondents planning to increase their allocation, minus the percentage planning to decrease) was -14.1% for equities compared to 41% for real estate.

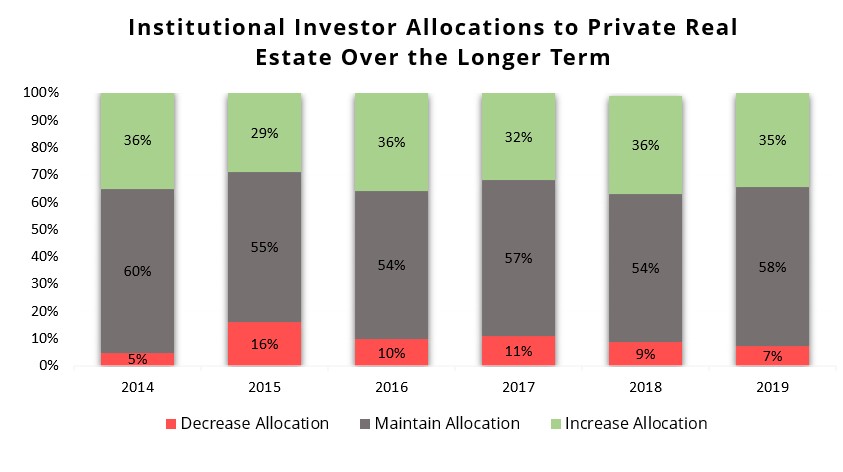

Importantly, the belief in real estate as a core component of a portfolio is not simply a temporary view among institutional investors. Preqin, a leading data provider for alternative investment professionals, produces an annual survey[5] of their global clients to uncover trends in capital allocation and highlight which asset classes are likely to be favoured by institutional investors. As the chart below shows, institutional investors have consistently expressed a preference to increase their real estate allocation over time. The most recent survey in November 2019 shows that 35% of investors are planning to increase their allocation, fives times the number of those planning to decrease their allocation over the long-term (7%). The annual survey results from 2014-2019 show a persistent bias towards allocating more capital to real estate over the long-term, highlighting the continued appeal of private real estate as an asset class among “smart money” investors.

With the potential for high absolute returns and low correlation to other assets, private real estate should be worth considering for many investors’ portfolios. Opportunistic strategies such as real estate development can also help provide capital growth, while selectively targeting multifamily developments can also position investors in an asset class that traditionally fares better through recessions compared to other forms of commercial real estate. Qualified Greybrook investors have the opportunity to incorporate one of the most popular institutional investment strategies in their own portfolios by investing in large-scale real estate development projects across North America.

Contact us to learn more or to speak with one of our investment representatives.

[1] https://www.bmogam.com/us-en/advisors/market-charts/global-negative-yielding-debt-has-reached-record-highs/

[2] Preqin, Weighted Average IRR performance of North American focused Opportunistic Real Estate funds, Vintage years 2000 -2017

[3] CBRE, “U.S. Multifamily Research Brief: Multifamily Most Resilient Property Sector to Recessions”, February 2019. (https://www.cbre.ca/en/research-and-reports/US-Multifamily-Research-Brief-February-2019)

[4] https://www.blackrock.com/institutions/en-us/insights/rebalancing-survey

[5] Preqin, “Alternatives in 2020: Preqin Global Alternatives Report”. 2019