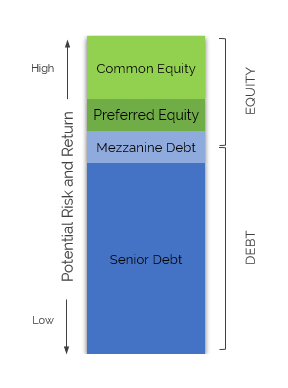

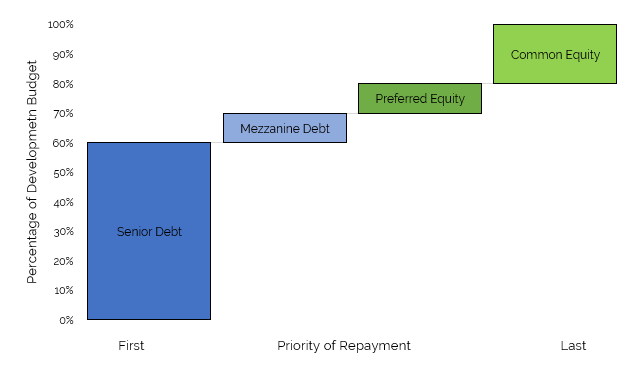

The sources of capital used to fund large-scale real estate development can take many forms, but will commonly be sourced from both debt and equity investors. These two categories can be further divided into senior or mezzanine debt, and preferred or common equity. Though a development may not always use mezzanine debt or preferred equity, understanding the differences between the various types of capital will help you properly assess the risk/reward trade-off of investment opportunities in this asset class, and allow you to better assess if an investment is appropriate for you.

If you are considering a common equity investment in a real estate development, you would receive either a direct or indirect ownership interest in the project, and uncapped participation in the profits of a project if it performs well. Common equity investors are the primary beneficiaries of profits generated and seek capital appreciation of their investment, rather than debt investors who are entitled to fixed interest payments with no participation in project profits.

Control of the development and major decisions are made by common equity investors—typically by the general partner on behalf of the limited partner investors. Compared to other sources of funds in the capital stack, common equity investors bear more risk as they are the first money in and the last money out. However, with average annualized returns that can range from 16%-20% or greater, common equity also has the highest potential returns of any layer in the capital stack.

Similar to mezzanine debt, preferred equity investors receive a regular interest payment. However, in some cases preferred equity investors may have limited participation in the profits generated. Preferred equity investors are repaid after debt holders (senior or mezzanine) though will have priority over common equity investors. The risk and return expectations for preferred equity holders is generally higher than mezzanine debt, but less than common equity.

Investors in mezzanine debt receive a prescribed rate of return, but do not have any participation in the profits of a development. Unlike senior debt holders, investors in mezzanine debt will not have a first mortgage to secure their loan. However, they may have a lien granted against the property or be assigned a partnership (equity) interest in the case of default, effectively making mezzanine debt a convertible debt-equity position. Mezzanine debt is more common in multifamily developments and is not generally part of the capital stack for condominium or low-rise developments.

When employed, mezzanine debt may comprise 5%-25% of the capital stack and is typically sourced from large institutional investors or private lenders. Returns for mezzanine debt are higher than senior debt and reflect the increased risk of the unsecured convertible loan.

In a development, holders of senior debt (a construction loan or permanent mortgage) are considered the most protected, as the property is held as collateral to secure the loan. As the largest layer of the capital stack—typically 50%-70% of total development costs—senior debt is the first layer to be paid back and sits in priority to all other sources of capital. Senior debt is usually exclusively provided by commercial banks, pension funds, or large institutional investors willing to accept a low rate of return in exchange for bearing the lowest amount of risk. Returns for senior debt investors will generally be significantly lower than equity returns and will range from the low- to-mid single digits annually for high-quality projects with reputable developers.

Private investments in residential real estate development can offer attractive returns for investors, however, it’s important to understand the benefits and risks of the various layers of capital within a development to ensure that it fits within your risk tolerance and investment goals.

Greybrook exclusively participates as a common equity partner and works with best-in-class developers to help produce long-term capital appreciation for our investors. While equity investments in large-scale residential real estate development have historically been controlled by high net-worth and institutional investors, our platform allows qualified individuals to access these investment opportunities directly.

Contact us to learn more or to speak with one of our investment representatives.