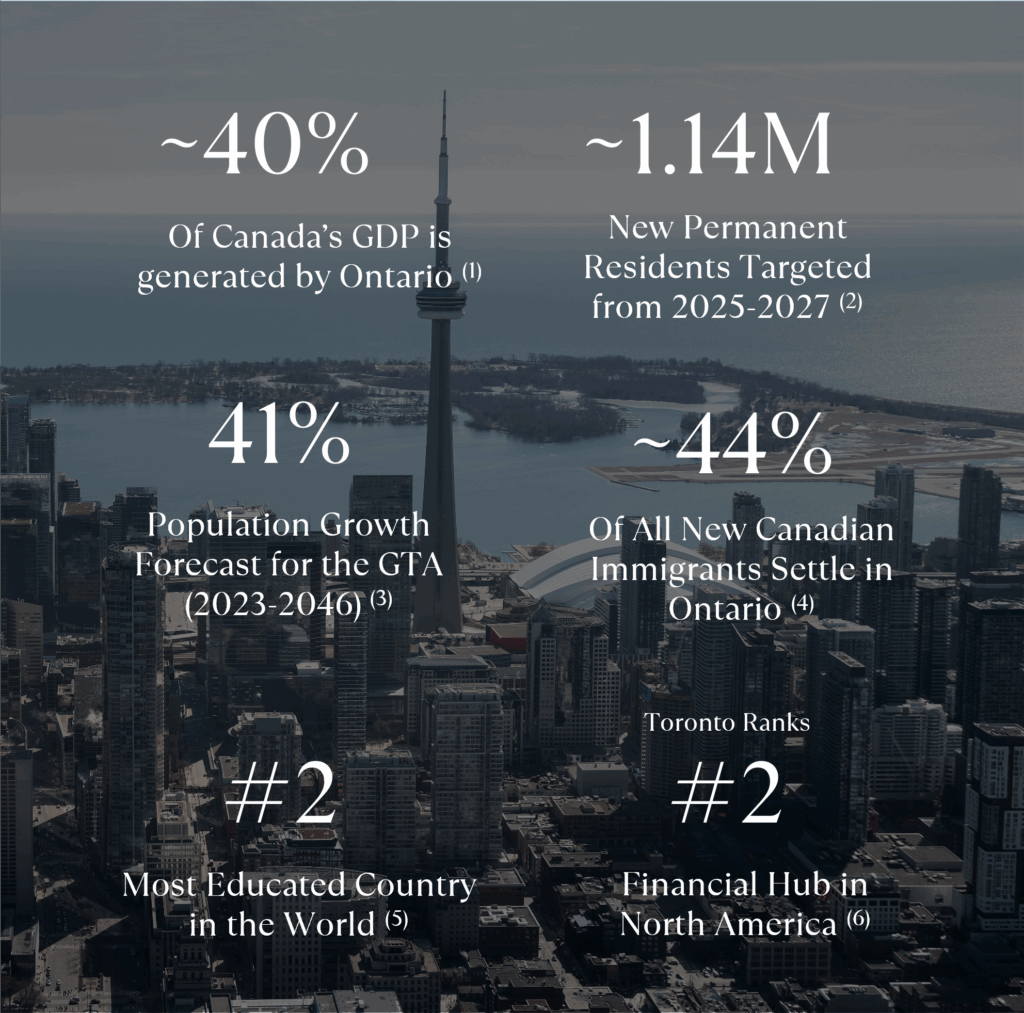

Growing Demand

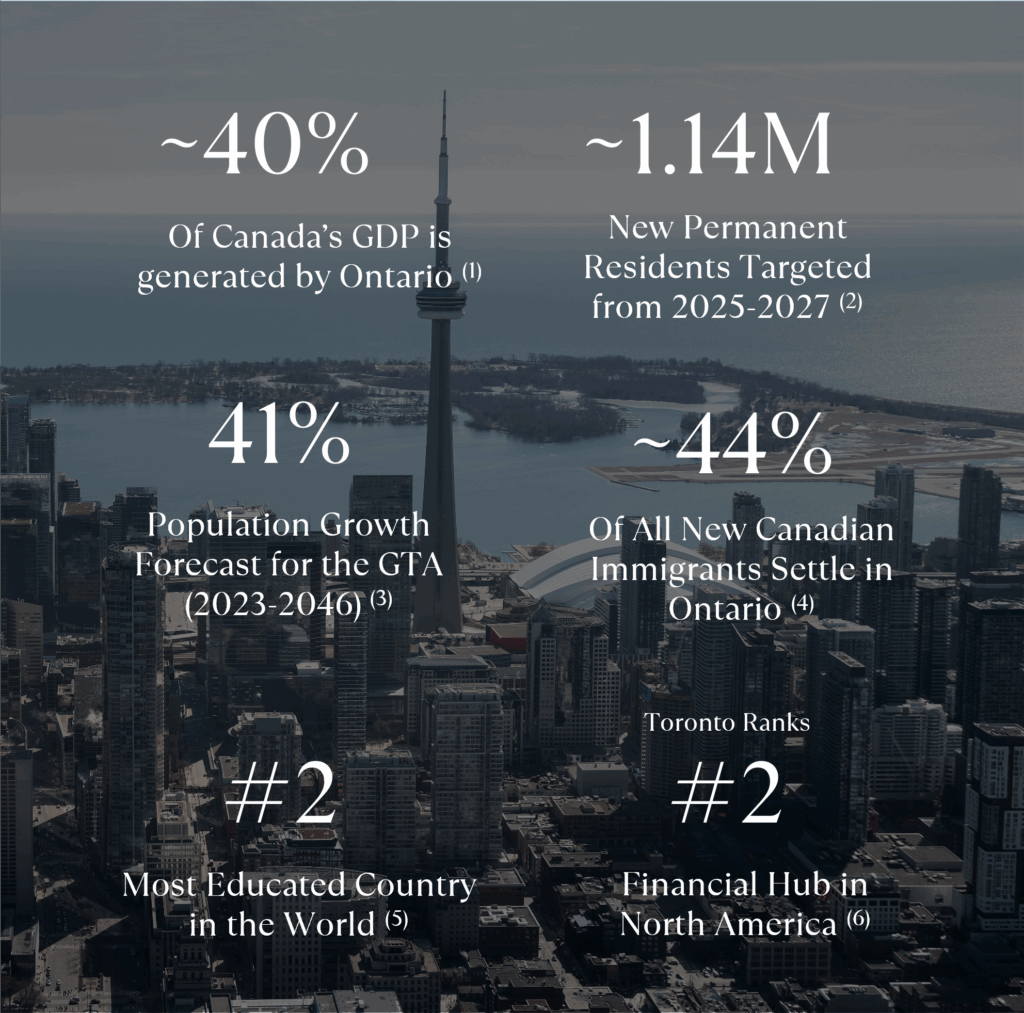

Ontario is Canada’s economic engine with the greatest share of newcomers annually, most settling in the Greater Toronto & Hamilton Area.

- With the GTHA and Greater Golden Horseshoe (GGH) at its core, Ontario generates nearly 40% of Canada’s GDP. Anchored by world-class universities and vibrant economic hubs, the region continues to attract talent, investment, and newcomers.(1)

- Canada’s immigration levels have consistently risen over the past number of years, with over 483,500 PR’s welcomed in 2024. Targeting an additional ~1.14 million between 2025 and 2027.(2)

- The GTA’s population is projected to grow 41% between 2023 and 2046, adding 3.1 million people to reach 10.5 million – half of Ontario’s total population growth during this period.(3)

- Population growth will continue to drive strong demand for additional housing in the GTHA and parts of Southern Ontario. However, a lack of available developable land in the GTA, coupled with time-consuming planning process, continue to be critical factors that limit the availability of new construction inventory.

- The imbalance has and will continue to put upward pressure on home prices over the long term.

Limited Supply

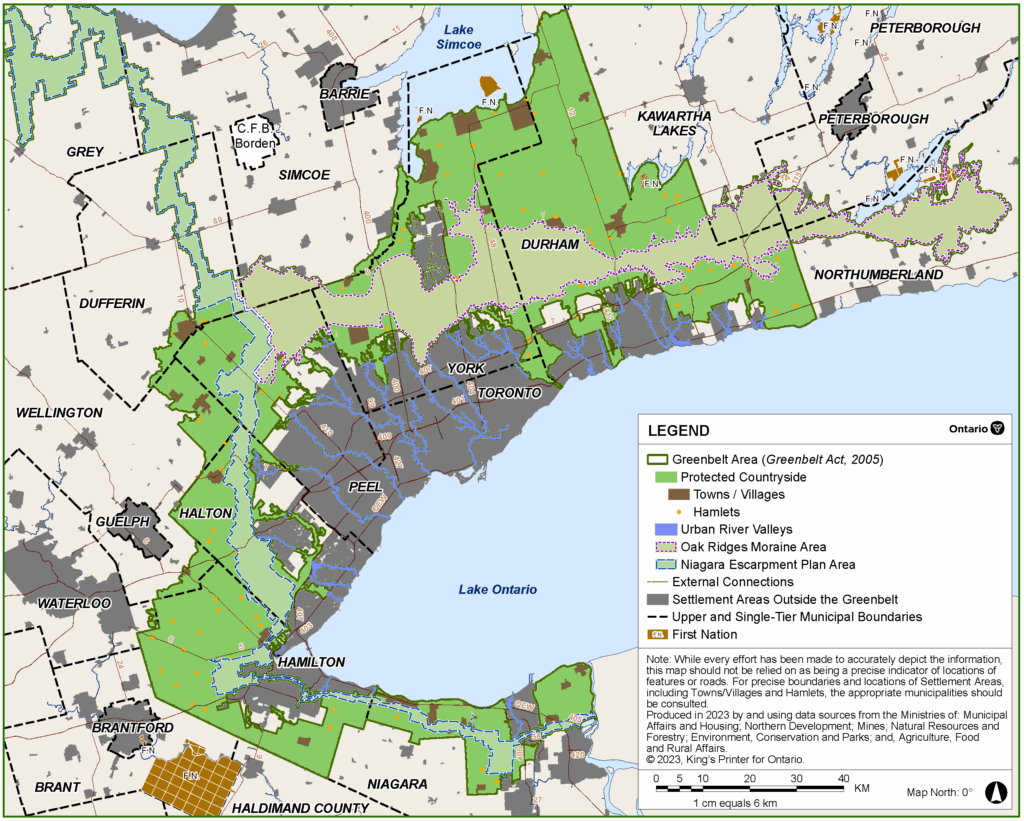

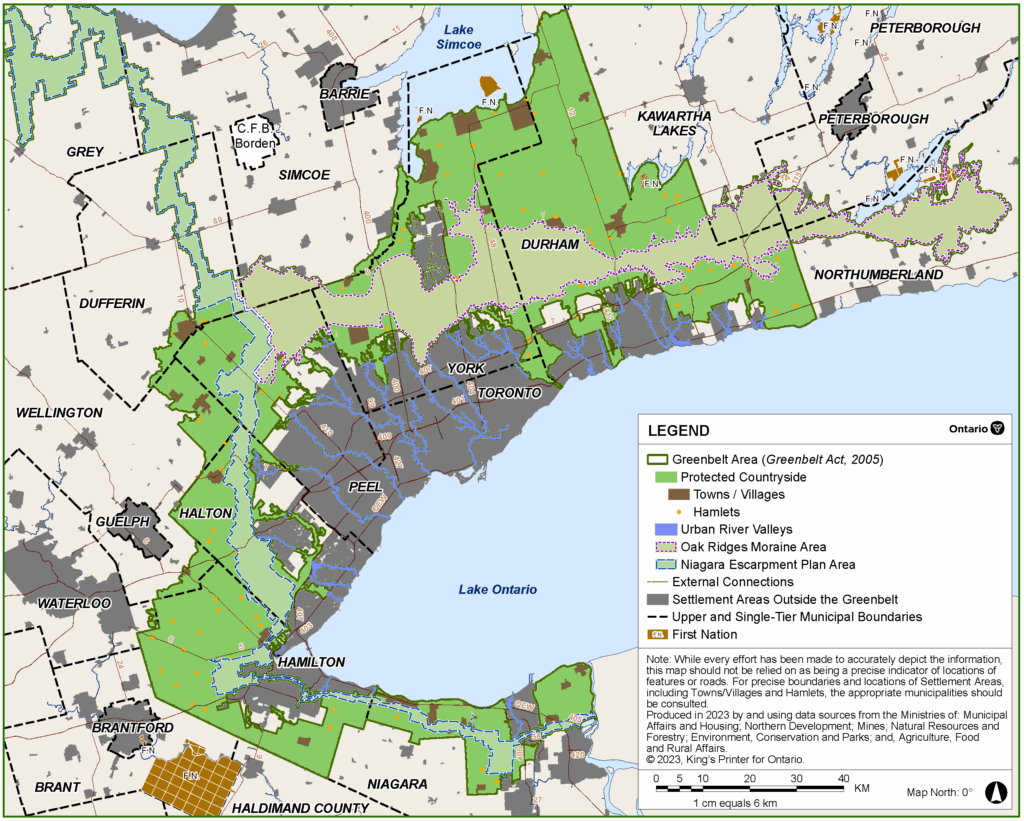

While the land area within the GTHA and broader GGH* is vast, the supply of available developable land is limited by legislative constraints that protect areas surrounding the GTHA.

- Developable land supply in the GTHA is limited due to geographic and legislative constraints and is encircled by a protected greenbelt creating a boundary to the north, east, and west of the region.

- The Greenbelt Plan, created in 2025 protects ~2 million acres of valuable farmland, forests, wetlands, and natural heritage systems that surround the GTHA. Together with the Oak Ridges Moraine Conservation Plan and the Niagara Escarpment Plan, the Greenbelt Plan limits urban expansion and the availability of developable land within the GTHA.

- In addition, provincial and municipal planning approval and infrastructure delivery processes consistently limit the industry’s ability to meaningfully increase supply.

- Furthermore, growing labour shortages across the construction industry limit construction capacity in the region, and together these factors are causing the region to fall short in providing the supply of homes needed to meet the growing demand.

Ontario’s Greenbelt(7)

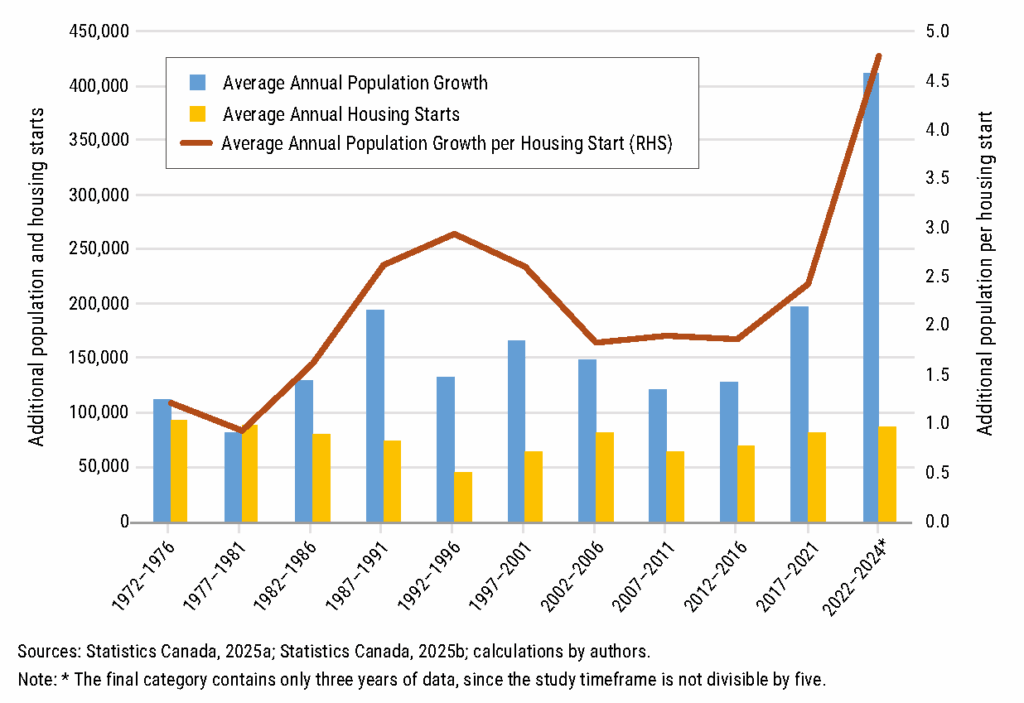

Housing Supply Gap

The housing supply gap across Canada, Ontario and the GTA will continue to put upward pressure on home prices over the long term.

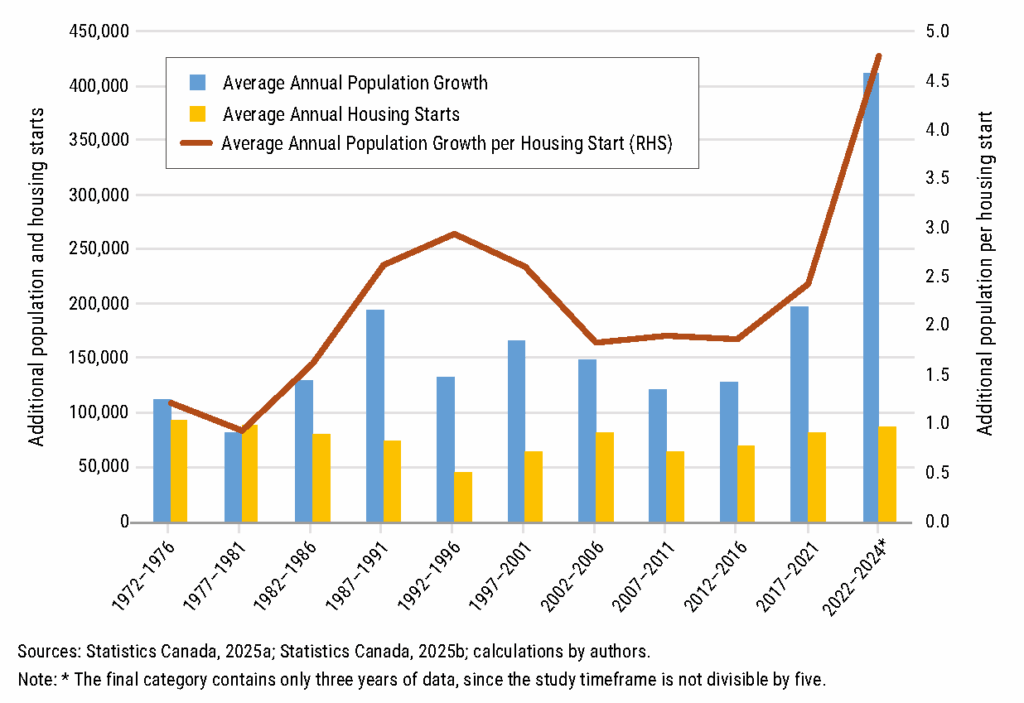

- To restore affordability to pre-pandemic levels, Canada needs to increase annual starts from a projected ~245,000 over the next decade to 430,000 to 480,000 new units annually. Toronto would need to increase annual housing starts by ~70% to help address the imbalance and ease pricing pressure (CMHC).(8)

- Ontario is continuing to face a deepening housing shortage, with estimated average housing starts from 2022 to 2024 of 86,650 per year (less projected in 2025), well below the 150,000 annual starts the province needs to meet its 1.5 million new homes target by 2031.(9)

- New home construction has not kept pace with overall population growth in Ontario and the GTA. A 2024 BILD report noted the number of new units started for every new person added to the population is the lowest it has been since the data began in 1972.(10)

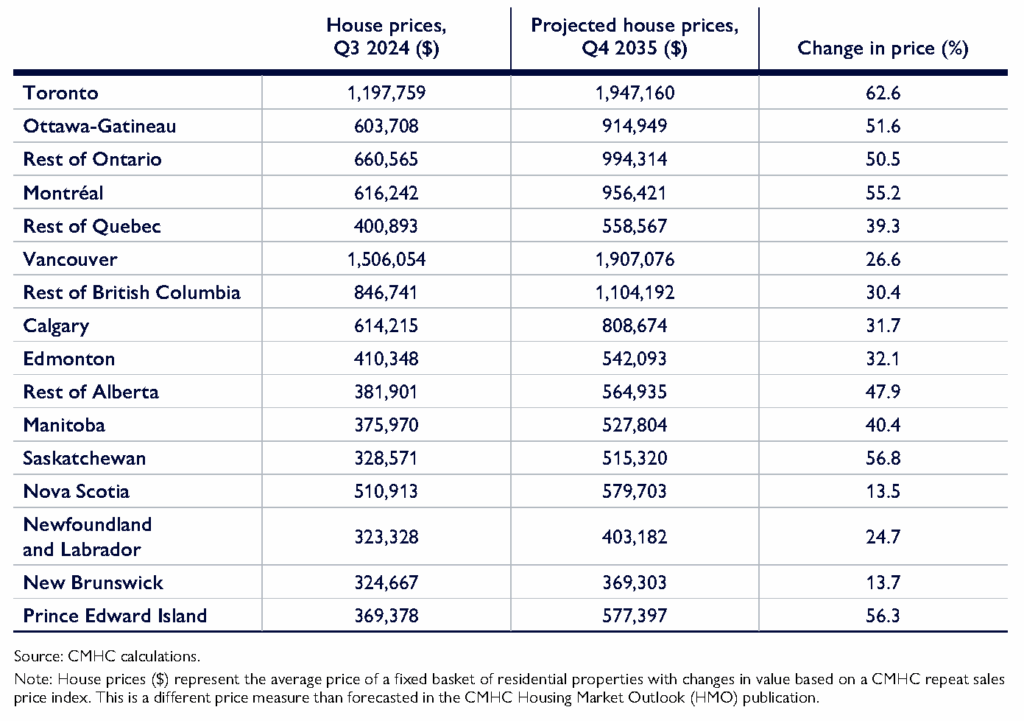

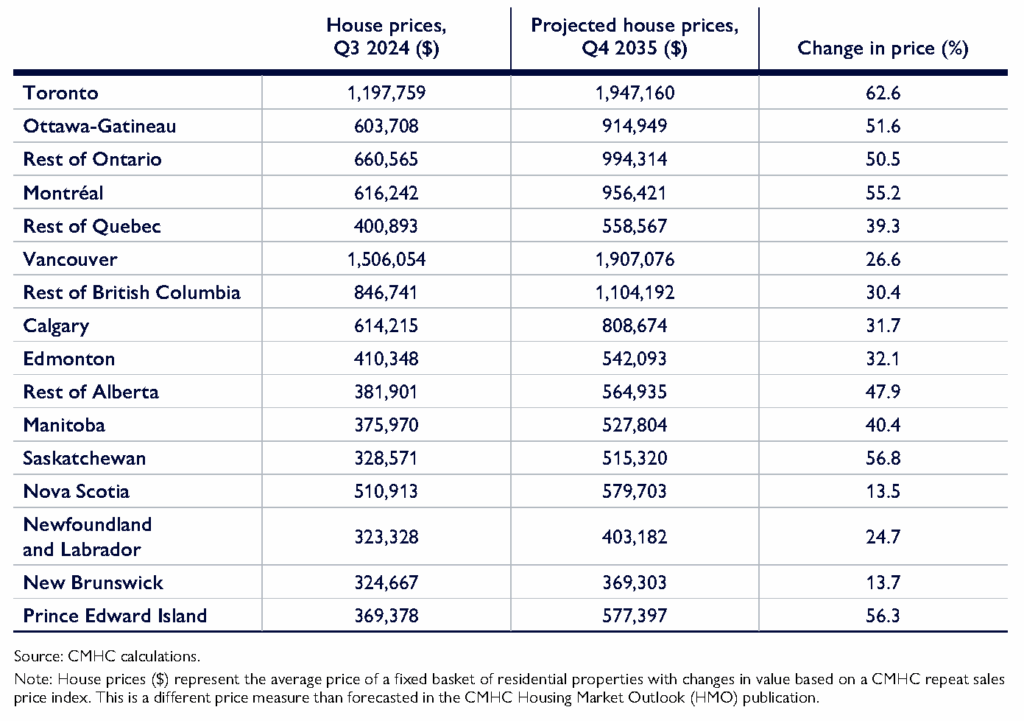

- CMHC projects that Ontario will need a dramatic increase in housing supply to meet population growth requirements and alleviate affordability pressures. If starts remain at the current pace, average Toronto home prices could rise from ~$1.2M (2024) to ~$2M (2035), among the steepest increases in Canada.(8)

Average Annual Housing Starts and Changes in Population in Ontario (1972-2023)(10)

CMHC Projected Home Prices Q3 2024 and Q4 2035(9)

(1) Government of Ontario – Harnessing Sector Strengths to Support Growth 2024.

(2) Government of Canada – 2025–2027 Immigration Levels Plan.

(3) Ontario Ministry of Finance – Ontario’s Long-Term Report on the Economy 2024.

(4) Government of Ontario – Ontario Demographic Quarterly: highlights of second quarter.

(5) OECD – Population with Tertiary Education.

(6) Toronto Global – Financial Companies and Services – Toronto: Canada’s Financial Capital, 2023.

(7) Government of Ontario – Greenbelt Plan 2023.

(8) Fraser Institute – Ontario’s Housing Mess Bad News for Canadians Across the Country.

(9) CMHC – Canada’s Housing Supply Shortages: Moving to a New Framework (June 2025).

(10) Altus Group Economic Consulting, Based on CMHC and Statistics Canada – Average Annual Housing Starts and Changes in Population in Ontario (1972-2023).